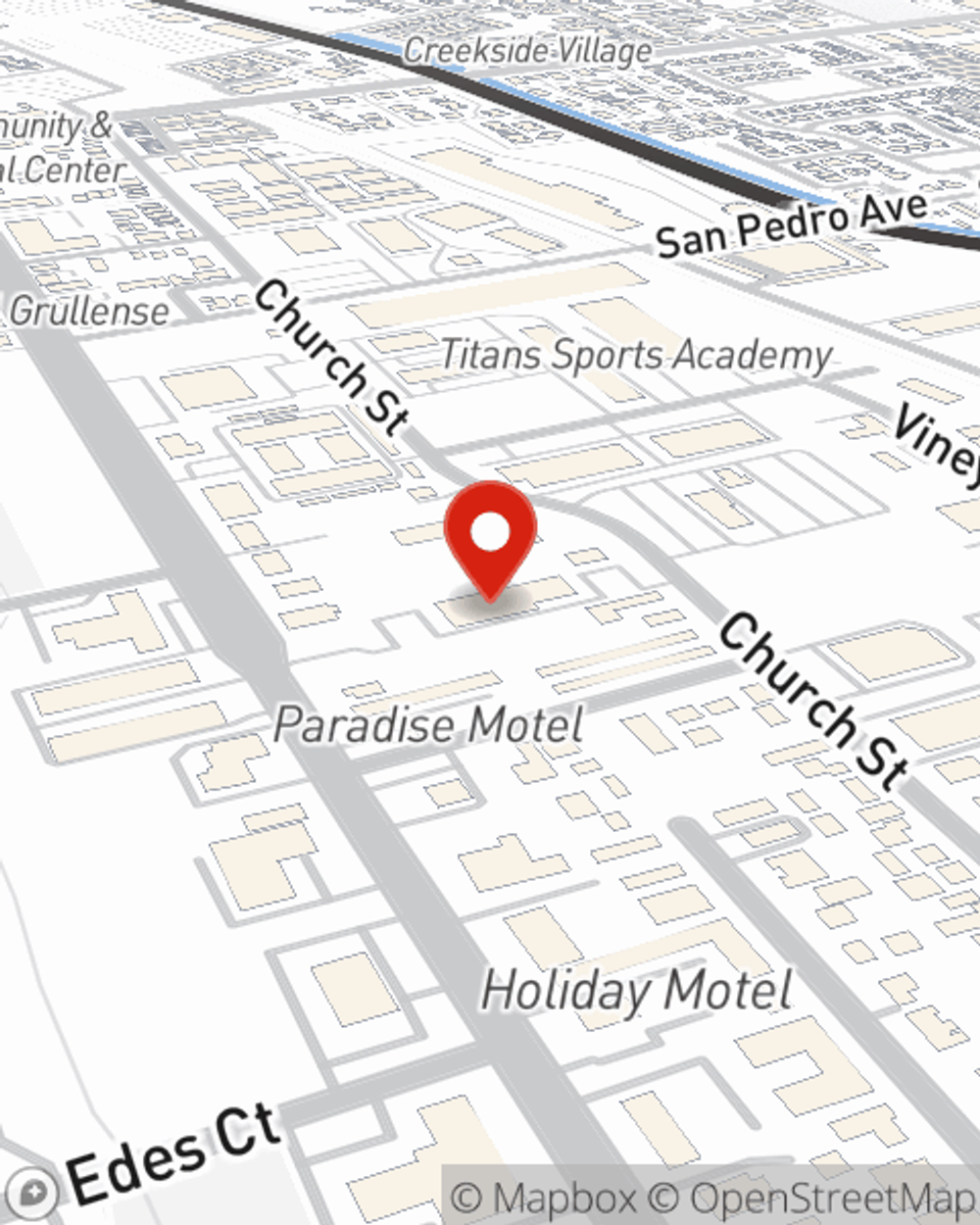

Condo Insurance in and around Morgan Hill

Townhome owners of Morgan Hill, State Farm has you covered.

Protect your condo the smart way

- Morgan Hill

- San Jose

- Gilroy

- San Martin

- Santa Clara County

- California

- The Bay Area

- Arizona

- Nevada

Home Is Where Your Condo Is

You have plenty of options when it comes to choosing a condominium unitowners insurance provider in Morgan Hill. Sorting through coverage options and deductibles is a lot to deal with. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Morgan Hill enjoy incredible value and straightforward service by working with State Farm Agent Kevin Bailey. That’s because Kevin Bailey can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as musical instruments, sound equipment, sports equipment, pictures, and more!

Townhome owners of Morgan Hill, State Farm has you covered.

Protect your condo the smart way

Protect Your Condo With Insurance From State Farm

When a hailstorm, theft or fire cause unexpected damage to your unit or someone is injured in your home, having the right coverage is significant. That's why State Farm offers such fantastic condo unitowners insurance.

As a reliable provider of condo unitowners insurance in Morgan Hill, CA, State Farm strives to keep your belongings protected. Call State Farm agent Kevin Bailey today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Kevin at (408) 612-4262 or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Kevin Bailey

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.